Compliance At Every Step

Protect against fines and penalties at every step with ID verification, fraud protection, document storage, and tracking and reporting.

Stats Title

Maximum per violation for certain FTC

Stats Title

Auto loan fraud exposure for top US auto

Features

& Benefits

Safeguard your dealership with features that help protect your reputation and bottom line.

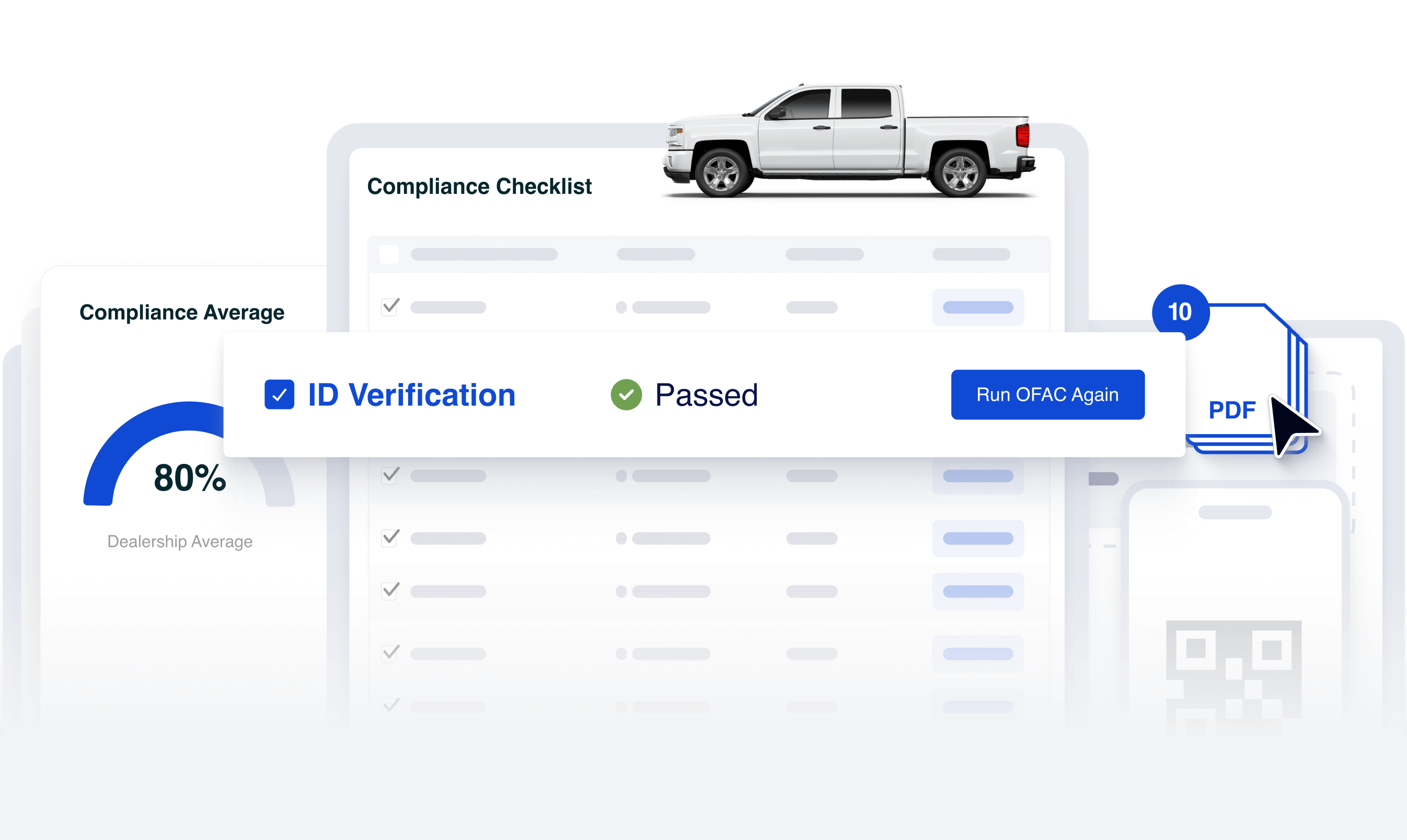

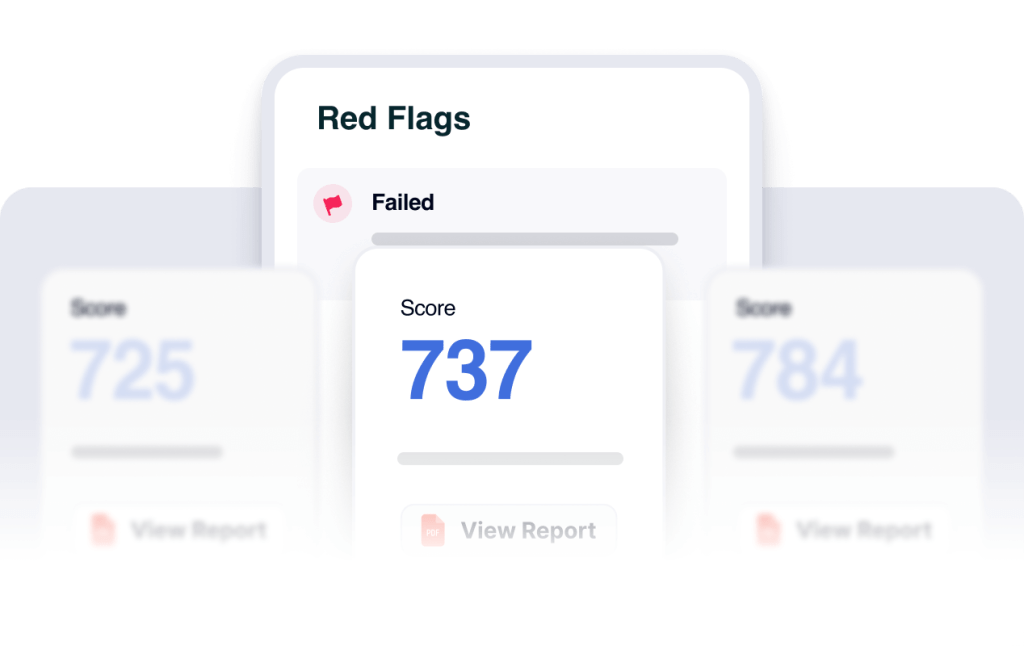

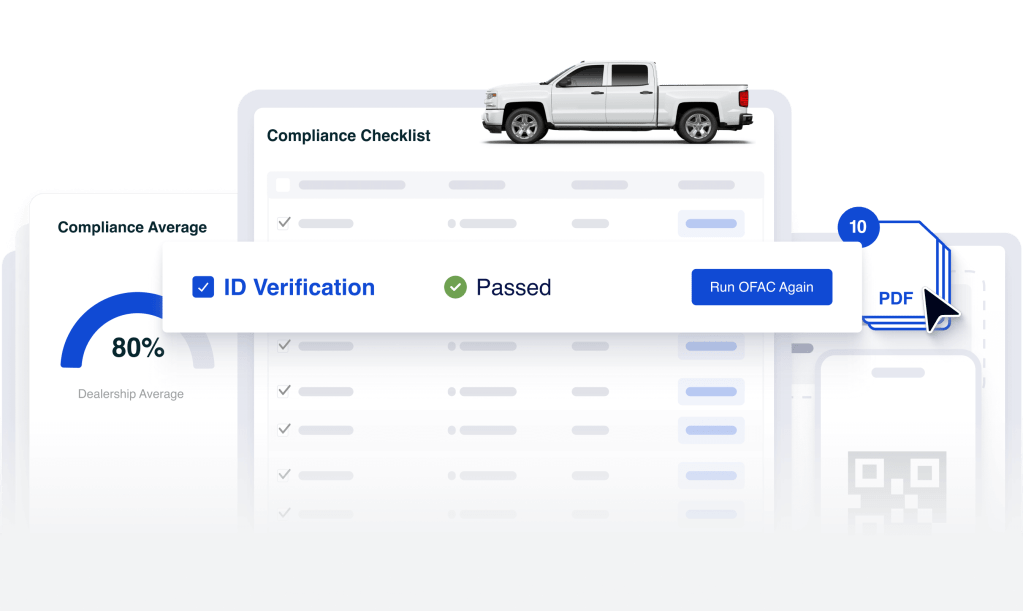

Red Flags & OFAC

Review and clear Red Flags and run OFAC checks using integrated ID checkpoints throughout each deal.

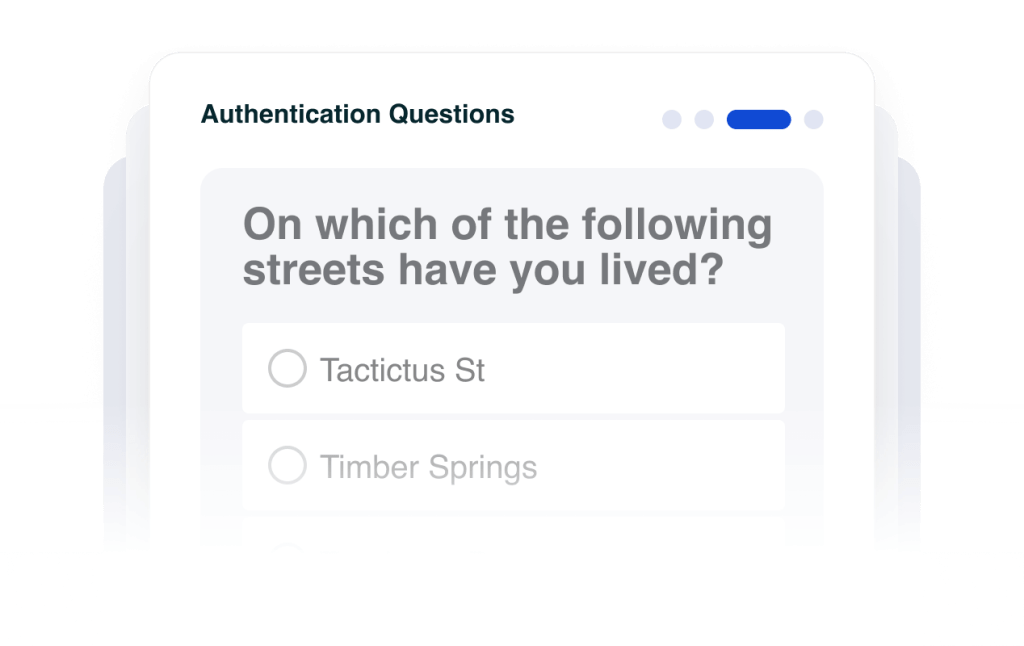

Out-of-Wallet Question

Verify identity by asking four questions only the customer would know.

Compliance Storage

Remain audit ready by securely storing deal documents in deal jackets within the state-mandated retention period.

Compliance Checklist

Ensure guidance through compliance steps with a checklist in each deal jacket.

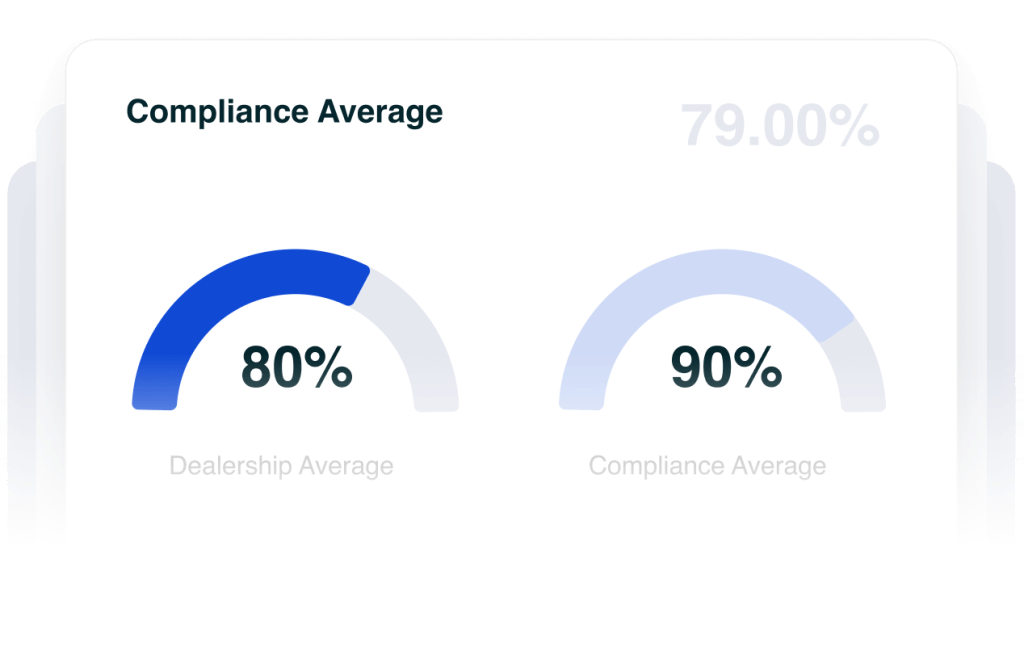

Dashboard & Reporting

Get a quick snapshot or a customized report of your compliance status by dealership or dealer group.

Available Add-Ons

Integrations

Our auto dealership software integrates with other Cox Automotive solutions and third-party car dealer management software. Sharing data across the dealership makes the customer experience seamless and builds trust.

Enhanced compliance

Storage

Enhanced Security And Easy Upload For

Every Deal Document

With the ability to upload any document and retrieve when needed, your dealership is protected and prepared in case of an audit with all documents stored in the customer deal jacket for the state required time.

All Dealertrack Compliance long term storage includes storage for 5 years in all states and 7 years in California

System-generated documents are automatically stored:

- Privacy Notice

- OFAC & ID Verification, Red Flags

- Risk Based Pricing Notice

- Credit Bureau Authorization

- Credit Application

- Adverse Action Notice

- Out of Wallet Questions

- Customer Investigation Report

- ID Alerts

- Dealer Participation Certification

- Vehicle Status

- 10k IRS

Storage with Dealertrack Compliance PLUS Enhanced

Compliance Storage

System-generated documents are automatically stored:

- Dealertrack Aftermarket Contracts

- Deal-Related Stips and Documents (Proof of Income, Driver’s License, etc.)

- Darwin Menu and Aftermarket Contracts

- Digital Contract and Funding Package Docs

Upload deal files directly into storage from your computer or scan a QR Code with your device camera

25 GB

Storage capacity

Now Available

The 2026 Compliance Guide

Stay informed on data security, regulatory compliance, and fraud risk in the auto industry—download Dealertrack’s complimentary guide featuring best practices, tips, and more.

Complete the form to download your free digital copy:

Required form fields

*While the CARS Rule may be gone, UDAP enforcement is here to stay. The Fifth Circuit Court of Appeals recently overturned the FTC’s Combating Auto Retail Scams (CARS) Rule on procedural grounds. However, other laws prohibiting unfair and deceptive practices remain in place across various jurisdictions.

Key Compliance Risks

losses from fraud reported in

applications submitted never get sold, but still need to be stored for audit

Real Stories With Real Results

Dealers today look for peace of mind when it comes to ensuring compliance at every step. See what dealers have to say about Dealertrack Compliance

Lou Bregou

I get a comfort level using the compliance product from Dealertrack…I know I'm being protected.

Director of Operations

Driver’s Village

FAQs

Our platform provides real-time updates, ensuring you are always aligned with the latest industry standards. Dealertrack Compliance provides a comprehensive set of tools to help you remain compliant at every step of the deal.

Absolutely. Our user-friendly interface is designed for ease of use, regardless of technical expertise.

Dealertrack Compliance integrates with Dealertrack F&I to provide checkpoints and guidance throughout each deal.

Dealertrack offers comprehensive support through phone, email, live chat, online help centers, FAQs, documentation, and training sessions to ensure dealerships can effectively use their solutions

By automating workflows and reducing manual tasks, our platform allows you to focus on core business activities.

We provide all you need to know to stay compliant

Get Started with

Dealertrack F&I

We know you may want to see a demo. Choose your preferred demo experience below:

Take a guided demo

Experience an immersive demo of the Dealertrack F&I platform. Don’t worry – you can connect with your rep at any time!

Connect with your account rep

Set up time for a live demo of the Dealertrack F&I platform with your account representative.